Govt to tax all traders without exceptions: Finance Minister M Haris

LAHORE: Senator Muhammad Aurangzeb, the Minister for Finance and Revenue, on Saturday categorically stated that taxes would be imposed on all traders without exception and at all costs under federal government’s commitment to meeting an ambitious revenue target projected in the budget FY25.

We will definitely address the problems that the budget for the next fiscal year has brought for traders,” Aurangzeb said, addressing business leaders at the regional office of the Federation of Pakistan Chambers of Commerce and Industry (FPCCI) in Lahore.

The event was graced by notable figures including Federal Minister of Finance & Revenue Senator Muhammad Aurangzeb and Minister of State for Finance and Energy Ali Pervaiz Malik. A significant number of business community members were also in attendance, reflecting the importance of the session.

In his address, Senator Muhammad Aurangzeb spoke with caution regarding the policy rate, underscoring its jurisdiction under the State Bank of Pakistan.

“However, there is room for the policy rate to be gradually reduced this year. We aim to increase the tax-to-GDP ratio to 13% over the next three years. Foreign exchange reserves have exceeded $9 billion. The budget needs to be viewed in a broader perspective. We will certainly address the concerns of industrialists,” he asserted.

He highlighted a unique challenge faced by Pakistan, noting that it is the only country where the concept of non-filers persists despite the availability of data.

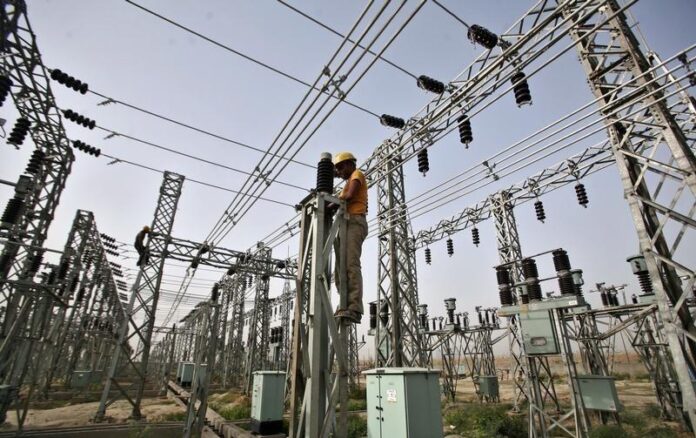

“The Federal Board of Revenue (FBR) has developed a mistrustful and distrustful image. We need to fix the FBR. The FBR system is being digitized to eliminate human intervention. Restructuring the FBR is crucial. We will work with the FPCCI research cell to determine strategies for boosting exports and running the industry efficiently. Although work on Independent Power Producers (IPPs) was done during the previous government with government sovereign guarantees, we are reviewing these agreements and if issues with distribution companies are not resolved, electricity prices will continue to rise. The budget has increased financing for SMEs, and domestic investors are as important as foreign investors,” he stated.

Senator Aurangzeb explained the government’s commitment to addressing the difficulties traders face in the national budget. He stressed that for the country to progress, the private sector must take the lead, as sectors flourish and exports grow when government intervention is minimized.

Minister of State for Finance and Energy, Ali Pervaiz Malik, addressed the session, noting the extraordinary circumstances under which the current national budget was presented. He assured the business community that relief would be provided as fiscal space becomes available.

“4.5 million new taxpayers will be included in the tax net. Taxing the salaried class and milk are tough decisions for any government. We understand these difficulties. As soon as space is available, relief will be provided to the public. Once we get the country back on track, everyone will receive relief. Government measures have reduced the inflation rate from 40% to 12%,” Malik stated. He also explained the urgent need to reduce interest rates.

Former caretaker interior minister Dr. Gohar Ijaz offered a critical perspective, suggesting that agreements with IPPs should be immediately canceled. “The interest rate should be reduced. Industrialists are the protectors of the country. It is not possible to do business at a 20% interest rate. A conducive environment for exports should be provided; only by promoting exports can the country’s debt be paid off,” he argued.

FPCCI’s acting president Saqib Magoon and other business community officials echoed the sentiment, advocating for the cancellation of IPP agreements and setting a target to increase exports to $100 billion.

They also explained the importance of involving FPCCI in policy-making related to industrialists, taxes, and exports. The business community suggested transitioning towards a zero-cash economy to expand the tax net and expressed concerns over high electricity rates.

They pledged that if electricity rates are reduced, they would significantly increase exports.

The session underscored the collective belief that breaking free from IMF dependencies is achievable through industrialization. The call for a 20-year industrial policy was clear, with aspirations to transform Pakistan into an Asian tiger.

The business leaders stressed the need to bring electricity costs down to 9 cents and the interest rate to 15%, arguing that a supportive environment for exports is essential for paying off national debt.